Years ago, the same big brands lived in the pantry of every home in the United States: the Heinz ketchup bottle, the stacks of Campbell’s soup, the Kraft Mac-and-Cheese boxes, and more. Now these brands are becoming obsolete within the average home. Instead, novel brand names are infiltrating kitchens.

Motivated by ingredient choices, health concerns, package labeling, and more, shoppers are making the choice to purchase small, and often local, brands. For the consumer packaged goods (CPG) industry, small brands may have a better chance than ever to succeed in the competitive retail landscape.

Small brand success

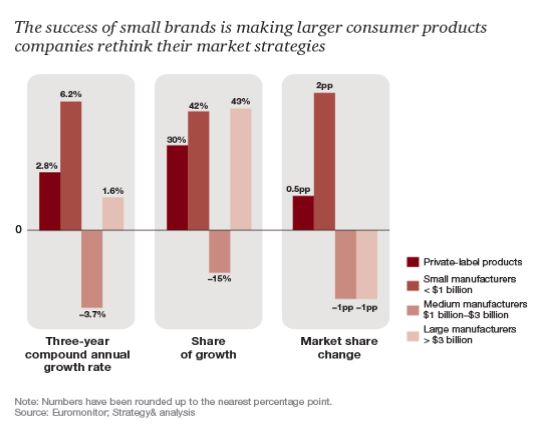

Small companies have been taking pieces of the market from large companies in the past few years. A 2012 study examined the market share growth of small, mid-size, and large companies from the prior three years. The study found that small, newer brands were succeeding while large and mid-size brands were losing their share and sales. In fact, in 2015, 62 of the top 100 CPG companies saw a decline in sales, and 90 of the 100 companies lost market share.

Consumers enjoy the authenticity, connection to local growers, and commitment to healthy ingredients that many of the up-and-coming brands have to offer. These new brands are innovating to the needs of consumers and offering unique stories to create an emotional connection to their brand.

Look at KIND, for example. Its 2008 fruit and nut bar launch into a crowded market provided consumers with see-through packaging to display an honest view of the food they’re going to purchase. The ingredients were simple, the recipe was healthier than most granola bars at the time, and the company had positioned the brand as a way to “spread kindness”. These small innovations led KIND to take over 10 percent of the market share by 2016, chipping away from large brands like Kellogg’s.

Big brand failure?

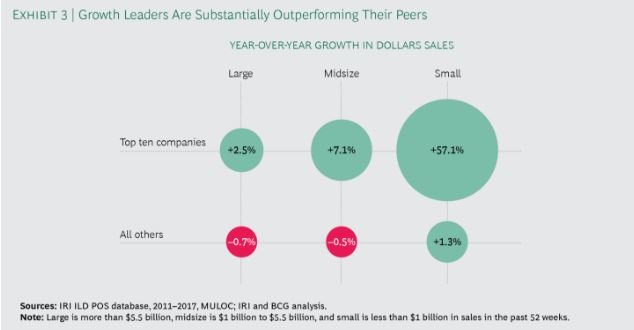

Does this mean the big brands are failing? The short answer is, kind of. Defining success is up to the reader. Large brands are not growing as much as small brands, and many may view this as a failure. However, the top ten large companies are still seeing overall growth in their categories. These companies, including Constellation Brands, The Hershey Company, Bimbo Bakeries, Coca-Cola, and more, saw a 2.5 percent increase in sales since 2016. However, they are still losing market share while the small companies gain it.

It is more challenging for large companies to make drastic changes for growth than it is for small companies. The decision-making process is longer because more people need to agree on a final decision before it is implemented. Dale Clemiss, president of Conagra’s grocery and snacks division, argues it is possible to do, but these changes need to be drastic if the brand is going to grow.

With new generations more willing to try novel products, big brands are at a disadvantage. While they could–and sometimes try–to create new products under the company name, it doesn’t quite have the same effect of a completely new label.

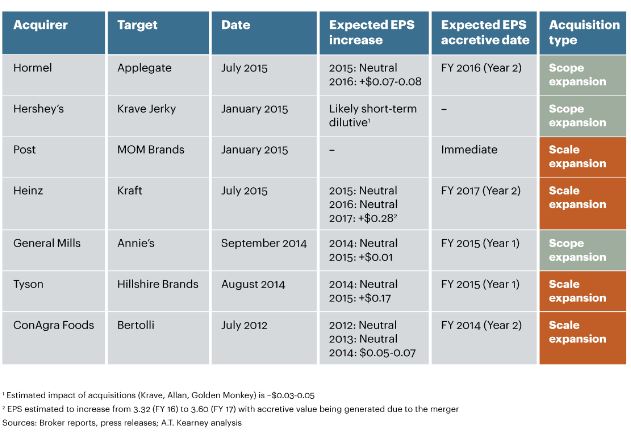

Large companies are developing a defense for these threats: corporate shopping sprees. Instead of spending money to develop new products under their name, they acquire the successful small companies. Some of the recent acquisitions from Coca Cola are Zico Coconut Water and Honest Tea; while Pepsi acquired Bare Foods; and Campbell acquired healthy snack brand Snyder’s-Lance.

Many of these large companies have venture funds to invest in the small companies early, so that they can keep up with trends and establish early relationships. Examples of these funds are General Mills’ 301 INC and Campbell’s Acre Venture partners. Opinions on this  strategy vary. While some believe it is the best use of the brand’s large budgets, others see it as raising corporate debts and hitting profits. According to a recent analysis by A.T. Kearney, most of these funds have yet to succeed and need to focus their goals more clearly.

strategy vary. While some believe it is the best use of the brand’s large budgets, others see it as raising corporate debts and hitting profits. According to a recent analysis by A.T. Kearney, most of these funds have yet to succeed and need to focus their goals more clearly.

The role of retailers

The increase in consumer desire for different brands also greatly influences the competitive madhouse that retailers live in. Customer loyalty and retention is key for retailers. They need to know what their consumers want and how to incorporate it into stores for the lowest prices. In response to a need for more small brands, many retailers have implemented programs to integrate local or small brands.

Stores like Kroger and Albertsons have stepped in to offer more local, small-brand options. In addition to an online portal, Kroger offers sampling and in-store education programs for small brands. H-E-B created a local food contest that invites local producers to attend community events with H-E-B representatives who give advice on product development. Then they choose which items they incorporate into the store.

While there are other drivers for consumers to decide on a retailer, such as location and pricing, the variety of products that a retailer has is a priority for 35 percent of consumers. That’s a large loss for retailers if the right brands aren’t on the shelves.

Companies taking major hits

Generalizations and trends are interesting, but the juicy details lie in who is getting hit the hardest. Certain brands are definitely getting hit harder than others, and it’s tearing apart the companies beyond just their sales.

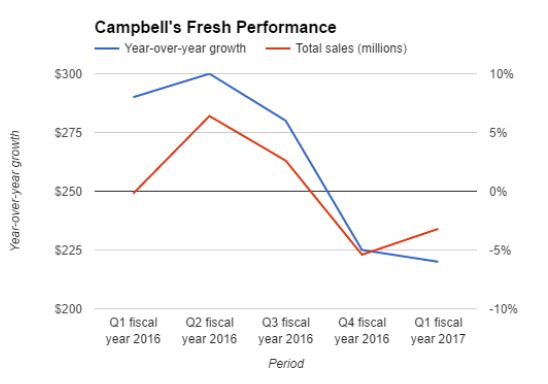

The Campbell Soup Company is in the spotlight right now across all retail media. While it maintained a household name for many decades, the past few years offered a bumpy ride in sales. The classics are not selling as much as the new and healthier options. Campbell’s Chicken Noodle Soup, for example, contains 1,390 mg of sodium per serving, while Pacifica’s Chicken Noodle Soup only has 460 mg. In a rush to innovate, Campbell’s acquired small snacks brands. While the correlation to the company’s current position in the market is unknown, CEO Denise Morrison stepped down this year.

DATA SOURCE: CAMPBELL QUARTERLY REPORTS. CHART BY AUTHOR.

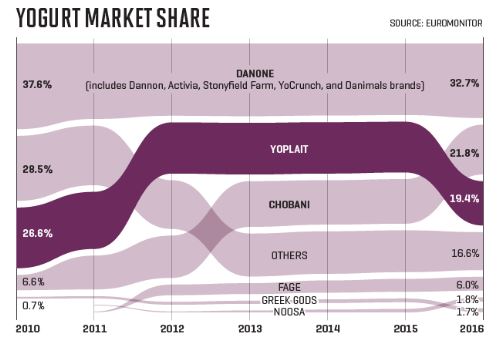

Yoplait is also gaining some media attention. It held significant market share of yogurt for the past few decades, but the category has greatly expanded since. Chobani emerged as a new player, but Yoplait did not see a threat and continued its same strategies. Now, twelve years later, Chobani has surpassed Yoplait and continues to see growth even though the yogurt industry is falling. Its innovation with its “flip” cups and yogurt drinks keeps consumers buying.

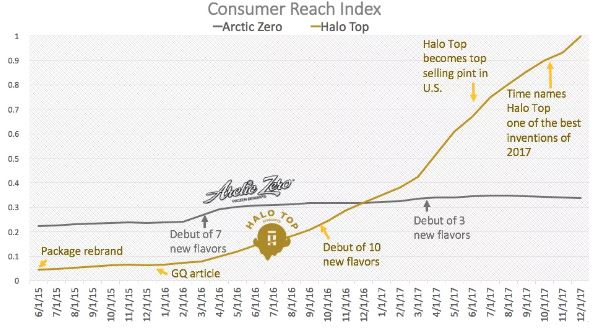

Ice cream industry leader Ben & Jerry’s is also facing the hard truth of the health-focused competition. Halo Top, a healthier “alternative” ice cream, outsold Ben & Jerry’s in 2017. The small brand, that may not be so small anymore, saw a 2,500 percent increase in sales in 2017. Other similar “health-conscious” products, such as Arctic Zero and So Delicious, are popping up next to the top ice cream brands now. As a response, Ben & Jerry’s launched a new “Moo-phoria” ice cream to compete with the rising trends and smaller brands.

Source: CircleUp

A morphing retail landscape calls for strategy changes from both brands and retailers. Now may be the best time for small brands to enter the market and large brands to reevaluate how to maintain their edge. Large brands are scrambling to make new products, invest in other brands, and acquire successful ones. With effective goals and strategies, large brands can take advantage of this shifting market toward healthier and smaller brands. However, if they do not manage to correctly navigate these changes, they may face serious loss in their market share.

Similarly, retailers need to consider factors that will retain their loyal customers and plan accordingly. It is obvious that healthy, small, and local brands are heavily influencing all corners of the retail industry. Many retailers are already making shifts to account for this, but it needs to continue further as the trend does. It is important for brands large and small, as well as retailers, to research and listen to consumers about what they are looking for as the market changes.