On June 21, 2018, the Supreme Court declared that states have the right to tax online sellers that do not have physical stores within their state. This went against a twenty-six-year-old ruling and will have a massive effect on online retailers, brick-and-mortar stores, and consumers. The debate is heated on whether the ruling was fair; however, states now have the go-ahead to create policies to collect billions of dollars in additional sales tax revenue.

History

The e-commerce taxation argument was a long, upward battle for the states. The Supreme Court rule, in effect since 1992, stated that retailers without a physical presence in a state did not need to pay sales tax. For example, an online retailer, such as the popular clothing store Revolve, did not need to pay sales tax on items they shipped to any of the forty-nine states, aside from California. This is because they have a physical store and office in the state of California. States argued this deprived them of major, potential tax revenue. Sales tax money for states is important to fund education, health care, and infrastructure programs; hence, the increase in online shopping is often blamed for massive cuts from these programs. In 2016, South Dakota noticed more residents shopping online and less sales tax revenue collected each year. After taking the issue to the lower courts, the court ruled against South Dakota by citing the 1992 ruling of Quill Corp v North Dakota. Yet, a 2015 comment by Justice Anthony Kennedy called Quill “doubtful” and ripe for reconsideration and gave South Dakota hope to carry the case further in court. The South Dakota v Wayfair Inc argument began on April 17, 2018, and concluded on June 21, 2018.

The Case

Five justices out of nine were needed to overrule the Quill Corp. rule. In the beginning, four justices felt strongly about each side, and Justice Stephen Breyer appeared to hold the key vote. “When I read your briefs, I thought absolutely right,” he told the lawyer for South Dakota. “And then I read through the other briefs, and I thought, absolutely right. And you cannot both be absolutely right.” Each side had valid points throughout the entire case, which made it a difficult decision to make. Below, the two sides are broken down by the main points made at the trial to support each side.

The states:

- The impact. South Dakota claimed that the tax would increase their tax revenue by $50 million, while all other states combined would see increases totaling $34 billion. This money goes toward important state programs.

- The trends of online shopping. Online shopping is increasing; therefore, the government sales tax revenue will be affected if more people choose competitive online pricing and stop shopping in stores that pay sales tax.

- The brick-and-mortar disadvantage. Stores within the state believed they were at a disadvantage compared to online competitors. They cannot compete with online pricing because of the lack of sales tax many of the e-commerce companies pay, and the National Retail Federation claimed e-retailers not being required to pay sales tax “undermines a fair and open competition in the marketplace.”

- Software needed. Even though new software would be needed to organize thousands of tax jurisdictions, Justice Ruth Bader Ginsburg argued that a market solution would be quickly created by entrepreneurs.

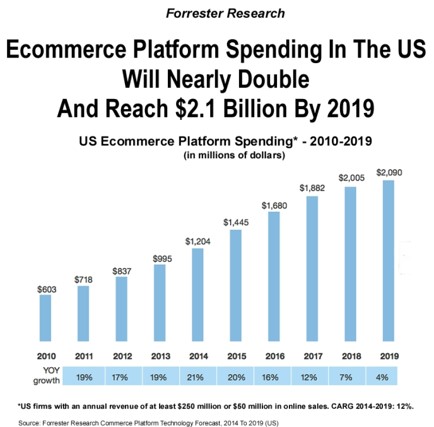

Source: Forrester Research

Source: Forrester Research

The retailers:

- The impact on government revenue. The state of South Dakota’s argument for a $34 billion national revenue increase was vastly inconsistent with the Government Accountability Office’s calculation of an $8–13 billion increase. The justices had these disparate estimations to consider when making their decision.

- The difference between small versus large online retailers. Large companies already pay state sales tax, such as Amazon, Macy’s, Apple, Target, and Walmart, because they typically have a physical store present in the state. However, smaller companies argued they are different because of the lack of a physical presence or resources.

- Varying tax laws. Smaller companies will need to conform to state and local tax regulations. This is not a difficult problem for companies because there are options out there that make it as simple as calculating postage (see example). The burden, interestingly enough, will probably shift to the actual tax collection agencies as they cope to process (and find violators for) tiny taxation amounts.

A case for Congress.

Many of the justices believed this was a case that needed to be taken to Congress instead. Justice John Roberts, who sided with the retailers, argued “e-commerce has grown into a significant and vibrant part of our national economy against the backdrop of established rules, including the physical-presence rule. Any alteration to the rules with the potential to disrupt the development of such a critical segment of the economy should be undertaken by Congress.” Congress made no statements in response.  The final ruling sided in favor of the states, 5–4. Small online retailers without a physical presence, including sellers on Etsy and eBay, are now taxable by the states. The current landscape allows states to determine the exact details of these laws. South Dakota, as the first example, requires out-of-state sellers who do more than $100,000 of business in the state, or more than two hundred transactions annually with state residents, to collect sales tax and turn it over to the state. In comparison, Washington state requires out-of-state sellers who do only $10,000 or more of business in Washington to collect sales tax for the Department of Revenue.

The final ruling sided in favor of the states, 5–4. Small online retailers without a physical presence, including sellers on Etsy and eBay, are now taxable by the states. The current landscape allows states to determine the exact details of these laws. South Dakota, as the first example, requires out-of-state sellers who do more than $100,000 of business in the state, or more than two hundred transactions annually with state residents, to collect sales tax and turn it over to the state. In comparison, Washington state requires out-of-state sellers who do only $10,000 or more of business in Washington to collect sales tax for the Department of Revenue.

Who This Hurts

Small online stores. Small e-commerce stores might see issues with these new laws because their prices will need to account for the change. If they are forced to increase prices, consumers might look into other options. In regard to handling the filing of taxes, businesses will most likely need to purchase software to assist them. Amazon and other large, third-party sellers. Amazon’s third-party sellers, which make up 52% of their sales, will have to start paying because Amazon is not likely to cover the cost. These are largely international companies that have avoided payment due to this arrangement. The consumer. These policies have the potential to affect the consumer in more ways than one. While their low-priced alternative options online may disappear, the existing options (brick-and-mortar and Amazon) will have less competition and more control over the price. Government tax agencies. While collecting additional sales tax revenue is beneficial, there may be a tough transition period. The amount of work required to track all online sellers will require additional workforce and policies. Maintenance to ensure the policies are being followed will also be required—possibly a time-consuming task. This is a win for them, but it might be tough to figure everything out at first and enforce later on.

Who This Helps

Smaller physical stores. Many people are guilty of trying an item on in a store, thinking about it on the way home, and then purchasing it online for a cheaper price. Showrooming, as this is called, happens when online competitors have a price advantage. The smaller stores that sell these items, while paying additional sales tax and shipping costs, are currently at a disadvantage when they sell to consumers. However, with this new law, there could be an increase of in-store purchases that will help the brick-and-mortar retail industry. Big-box stores (Amazon, Target, Walmart, Best Buy). Amazon, as previously mentioned, already pays sales tax in forty-five states where it has physical warehouses and locations. It will benefit from the ruling because it buries the competition of small online sellers. The smaller online companies will need to increase their prices to cover the cost of taxes. Large online sales platforms. Sites such as eBay, Etsy, and other online marketplaces will likely quickly build this into their system and offer it as a free service for their sellers, in addition to online shopping carts such as Instacart. However, there may be a burden for companies that use their own custom shopping carts or don’t have a large development staff. Governments. This is rather self-explanatory, but each state government will receive the additional sales tax revenue. New software companies. The grand prize winner is the software companies that have the programs to make all of this easy. A few examples are Taxify and Avalara, who should see a large increase in business soon.

Lingering Questions to Ask

Are prices going to increase across the board for online items or increase in specific cities, states, and locations?

It’s difficult to say. For example, Oregon does not have sales tax, but Washington does. For this reason, many residents of Washington who live on the border will go to Oregon to make everyday purchases. Applying that concept to the e-commerce industry becomes blurry. Would Washington residents be charged their state’s entire sales tax on an item bought online while Oregon receives no additional charge, or will it be averaged out and added to the overall cost of an item? Applying this across the nation could make for some confusing, arguably unfair, price increases in states that have no sales tax to make up for the sales tax of other states.

On average, how much of a price increase would be expected?

Take out a calculator because it is time to crunch some big numbers. If the total online retail sales for 2018 is $2.1 trillion and the total sales tax revenue across the United States is $34 billion, then there should be a rough average increase of 1.6% on every item sold online.

Will consumers move to brick-and-mortar stores now?

According to SmartInsights, the second and third top reasons that people shop online are because of the price advantages. By removing the likelihood of more competitive online pricing, there is a chance people will make more in-store purchases. However, pricing differences will still remain, and the ability to check prices online is a key factor in online shopping. The number one reason people prefer online shopping is convenience and comfort, and this reason will not be affected by these new laws. The changes in habits will, most likely, not be too drastic for consumers.

Looking Ahead

The next few months will be filled with new software, online business changes, potential price increases, and more. There are many unknowns after this ruling and many decisions to be made. States will decide whether they want to join South Dakota, small online stores will decide how to restructure their business plans, and consumers will decide whether they are still getting better prices online. Overall, this will play a massive role in the development of the e-commerce landscape.