In a blink, the first half of 2018 passed. Those six months flew by, but not without plenty of excitement in the retail industry. Major disruptions hit the market, new players entered the game, and old players retired from their roles. In case you forgot about all the excitement, which is easy with new headlines every day, here is recap of all the major moments in retail so far.

- The “retail apocalypse” lives on. The horror stories of big-name businesses declaring bankruptcy continues. Toys-R-Us, Claire’s, and Nine West are among a few of the names forced to close all their locations and liquidate any assets. There are no signs of this trend slowing for department stores, so it is time to start placing bets on who is next to exit the industry.

- CEOs moved in and out of positions quicker than a company’s interns. Over the past two years, at least sixteen major packaged-food and beverage chief executives have stepped down, according to a Wall Street Journal analysis. Within the past few months, the CEOs of Campbell’s Soup Co., General Mills Inc., Mondelez International Inc., Kellogg Co., Nestle USA, Hershey Co., J.M. Smucker Co., and Hostess have all stepped down from their positions. The retail landscape is changing, and old-fashioned CEOs are not equipped with strategies to stay competitive.

- Amazon officially took over Whole Foods. This major shake-up began in 2017 but developed throughout the last six months. While this acquisition could have an entire blog post of its own to discuss the past, present, and future of Whole Foods, it appears plenty of people have expressed their opinions already. To summarize some of the changes: prices dropped, delivery and slotting fee policies were put in place for vendors, brand representatives were banned, small and local brands lost their beloved place, and of course, Amazon Echo devices showed up everywhere.

- More Amazon, of course. Amazon opened its first AmazonGo store, grabbing lots of media attention. Stock rose, and customers flooded in to see if they could “steal” items. Overall, they saw much success opening, and there is now potential for more locations in the future.

- All new trends share one thing in common: a focus on health. In 2017, major chains such as CVS rearranged their planograms to encourage healthy eating. So far, 2018 had major CPG brands, such as Kellogg’s, cutting back on sugar in their biggest products. Governments even stepped in and demanded less sugar by implementing new regulations and adding sugar taxes.

- In-store experiences got creative. Studies show younger generations want to spend their money on experiences, rather than products, so why not bring the experience to the product? Between the AmazonGo cashierless-store experience, growing mushrooms ripe for harvesting in a Whole Foods store, and talking Coca Cola machines, brands are looking to build emotional connections with their consumers through these interactive experiences.

- Artificial intelligence (AI) continues to break into the retail world. From robots in Walmart and b8ta to Amazon drones delivering food, the AI industry is finding its place within the retail world. These technologies have a long way to go before they are fully functioning, but the digital disruption is beginning.

- Private labels: Private label popularity continues to increase as consumers desire the high qualities and low prices that they deliver. Specifically, retailers are recognizing the potential role of private labels in creating a stronger consumer relationship with store brands while increasing profits.

Taking time to reflect on the big moves in the past is equally as important as planning ahead. Many predictions emerged in the beginning of 2018, but how have those played out so far? Trends such as AI, brick-and-mortar innovation, and consumer-focused foods are expected to continue as key themes in the next six months.

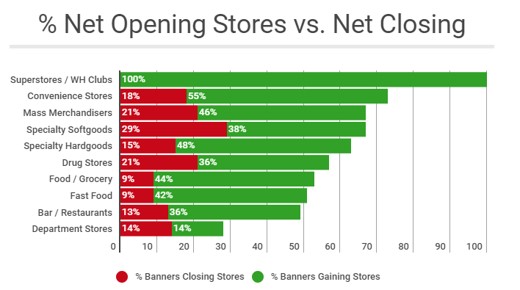

- More brick-and-mortar stores. Contrary to popular belief, more physical stores are opening than closing now. This whole “retail apocalypse” only applies to department stores. The data is limited for 2018 so far, but 2.7 stores opened for every one that closed in 2017, and this trend is expected to continue. Department stores are struggling the most, while superstores, convenience stores, mass merchandisers, and grocery stores are flourishing. In part, this is due to the expanding technology for point-of-sale and retail-management systems that help some CEOs understand the consumer better than ever before.

Source: IHL Group, Company Reports

Source: IHL Group, Company Reports

- Artificial intelligence is here to stay. A 2018 report estimated a thirty-eight-fold increase of the retail market by 2025, totaling $712.6 million. At the rate that these technologies are moving, it is difficult to tell what might arise in the next six months. Right now, image recognition, store robots, delivery drones, and self-driving cars look to be the most promising technologies in the short time that is left this year.

- Lower prices for healthier foods. Retailers, mostly health-centered chains, are taking action on the race to help consumers eat healthier. Natural Grocers, a chain throughout the United States, recently started a “good4u” campaign

that is lowering prices of healthy foods and offering classes to learn about nutrition. Retailers are taking responsibility for consumer health, working to provide better options, and gaining consumer trust. More affordable health food programs like these are coming in 2018 to stores such as Walmart and Sam’s Club. It is expected that more stores will follow in these footsteps and encourage healthier eating for their consumers.

that is lowering prices of healthy foods and offering classes to learn about nutrition. Retailers are taking responsibility for consumer health, working to provide better options, and gaining consumer trust. More affordable health food programs like these are coming in 2018 to stores such as Walmart and Sam’s Club. It is expected that more stores will follow in these footsteps and encourage healthier eating for their consumers.

- AmazonGo competitors. It didn’t take long for tech-giant Microsoft to hop onto the playing field of the retail world. Information from Microsoft leaked last week that the company is developing a cart that will sense products to allow for a checkout-less process. Sound familiar? The second half of 2018 might see more than just these two fighting for a spot in the retail industry, and the battle should be interesting to watch.

This year is a big year in retail, which makes for an exciting newspaper read while enjoying a morning cup of coffee. It feels like every day, tech giants are releasing new technology to disrupt what already exists, CPG brands are changing their branding and products quickly to adapt to consumer preferences, and retailers are demonstrating fun new strategies to remain competitive. The next six months will be exciting.