Can you guess what 60 percent of the average marketing budget goes to for CPG companies? Here are a few hints:

- It is a market that brings in $100 billion per year.

- It isn’t advertising.

- It requires a meticulous analysis and understanding of the shopper.

- It entails careful combination of many aspects to produce a profitable outcome.

- It has shown to be the most effective way to increase sales.

- Last one . . . It is purely in-store

Surprise! The answer is trade promotions, aka vendor funds. Trade promotions crawl into the brains of consumers and whisper the sweet nothings that result in impulse buys. Companies analyze the shared psychology of consumers so they can craft multidimensional game plans.

How the game has changed

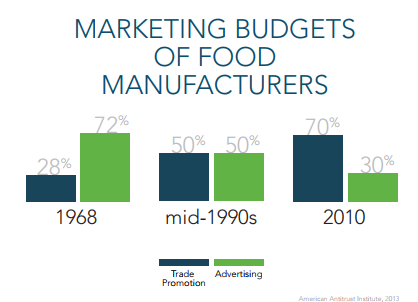

The past fifty years have shifted the minds of the consumers, which has forced CPG companies to shift their retail marketing approaches to match the emerging behaviors. POPAI’s study discovered that 76 percent of purchasing decisions are made in-store, which is much greater than consumers’ decisions in the 1970s. As a result of this change, companies have shifted their budgets away from advertising and toward trade promotion.

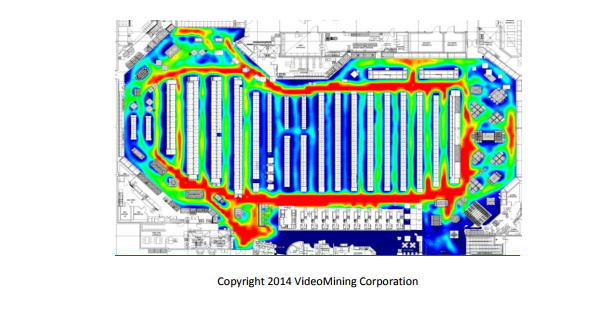

New technology has allowed retail stores to track general consumer behavior, and the results are unbelievably valuable. A study done by the National Science Foundation revealed that a majority of shoppers did not choose products based on brand loyalty but instead chose from promotions and pricing. The study also managed to track consumer traffic and pinpoint effective displays for further analysis.

Drafting the game plan

Trade promotion isn’t as easy as throwing some money toward a store and hoping for the best. It is a careful balance of strategies that target an individual consumer’s thoughts. There is no exact science for creating these strategies, which allows many companies to take different approaches in their trade marketing. Here are some of the possible plays for the game plan to increase sales.

“Property”

A huge part of getting into the head of a consumer is getting in the eyes of the consumer—often. By buying the best “retail property,” the consumer will notice the product more often, and both brand awareness and sales will increase.

- “Beachfront property”: Exactly as it sounds, beachfront property is the front-of-the-store display that attracts the attention of consumers immediately as they walk in. These are confined to a small amount of space, so they are fairly limited in quantity and force almost every customer’s eyes to it.

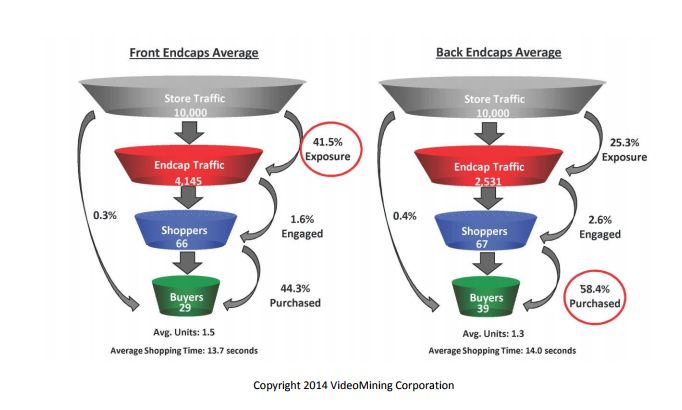

- “Powerhouse of property”: Using Coke’s 360 degrees approach to have product “always in reach,” the endcaps of the aisles are extremely powerful in marketing. According to Category Management Association, endcaps receive 41.5 percent more traffic than products in aisles receive. Of all the customers who walked by endcaps, 1.6 percent interacted with them, and 44 percent of that 1.6 percent actually purchased the product. In total, 0.3 percent of total customers entering the store purchased an end cap item. That 0.3 percent is huge for companies that have endcaps across a nation’s chain. In fact, front endcaps receive around 16.2 percent more exposure than those in back, but products on back endcaps are purchased 0.1 percent more by total shoppers.

- “Easy-on-the-eyes property”: The eye-level-is-buy-level approach takes advantage of the laziness and quick decision-making of a consumer by placing products at eye level on the shelf. The space is purchased through a deal with the store’s managers via slotting fees and is usually much more expensive than top or bottom rows are. It is also important to note the eye level for children is another premium area on the shelf, desirable for marketing to the younger audience.

Point-of-purchase displays

To increase brand awareness, point-of-purchase (or POP) displays can be used to grab the attention of consumers. These displays are typically presented near the product and attract the shoppers’ eyes, which is more relevant than ever with increasing in-store impulse buys. They are easy to produce and cheap to install, so it is easy to test the effectiveness of different types of POP displays on a small scale before larger implementation. Retailers are quite receptive to allowing displays that inform and entertain at the same time because results are generally positive.

What a deal!

Everyone is guilty of buying an item because it was too good of a deal to pass up. That’s the consumer mind-set—a deal that saves thirty cents causes them to make an unplanned purchase.

- Coupons: A whopping 80 percent of consumers stated that coupons influenced the brands they bought and the stores they shop in. With the increasing accessibility of coupons via mobile platforms, their use can bring in sales and act as low-cost brand awareness.

- X for Y!: Offering multiples, such as 10 for $10, is a popular trade spend. It only applies to specific items that can be stored in larger quantities, so this works well for only a small sector of items. According to Nielsen, this deal will be most effective when the item is under $1 per unit, and the offer is for more than ten units.

- BOGO: “Buy one, get one free” is a popular strategy that consumers love. The thought of getting something free triggers the buy impulse for many consumers.

Picking the players

For the starting lineup we have . . . cheap products, paper towels, easy-to-eat meals, and frozen bread! In the world of trade promotion, not all products are created equal, and some industries see greater success than others in implementing their strategies. It is important to recognize what products succeed in which areas of trade promotion to maximize return on investment (ROI).

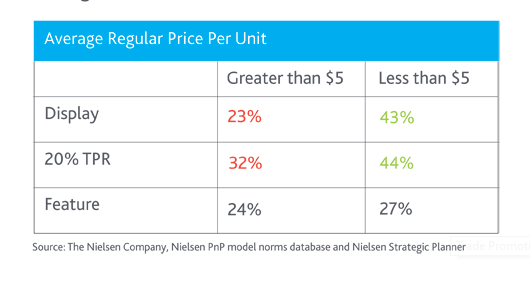

- Cheaper products: Considering the target consumer doesn’t intend to buy the product upon entering the store, the more expensive items become much less likely to be purchased. Nielson notes that trade spends on products under $5 are twice as effective as those that are over $5.

- Stockables, must-haves, and easy-to-eat products: Displays for these products bring in high purchase volume. These items are the most common impulse buys.

- Beer and ice cream: These two products are prime examples of what not to put on an end cap. Although they do drive sales into the aisle, the end cap product is rarely bought without inspection of other options. With many choices in the aisle and high brand loyalty, it is an extremely ineffective spend.

- Frozen bread: In contrast to beer and ice cream, frozen bread did exceptionally well compared to other products on an end cap. This may be because there is a small selection of the product. The consumer may not be aware of the product among the overwhelming quantity of items in the freezer section. Giving it a spotlight allows the product to stand out and succeed.

Game Time

A good game always has a solid defense, even in the world of trade promotion. Although everything is drafted out exactly how the play should go, it may fail to increase sales for numerous reasons. A Nielsen study observed a 55 percent failure rate of trade promotions for either the retailer or manufacturer. Bain & Company, a management consulting firm, goes even further and cites other studies that estimate up to 90 percent of trade promotions are simply not profitable. Why is that?

- Manufacturer strategy: Trade promotion is a game of “try, try again.” Often, that carefully constructed game plan does not bring in the expected ROI because it did not work on the consumer.

- Retail execution: Sometimes the retailers simply do not put the displays up or offer the appropriate deals. It isn’t that the trade promotion plan isn’t good enough; it’s that the retailers are not implementing it in their stores. Without constant reliable data measuring promotional displays, this is an issue that prevails for many companies. It can be extremely difficult to check up on every trade promotion when they are nationwide. A survey by Booz Allen Hamilton revealed only 22 percent of trade promotions are tracked on the individual store level.

- Retail compliance: Store compliance with manufacturers’ direction suffers in the trade promotion industry.

Time Out

If the ROI is not positive, it’s time to take a timeout and reevaluate the game plan. Where did it go wrong, and what can be done to get around the new “defensive” issues?

Check your own playbook:

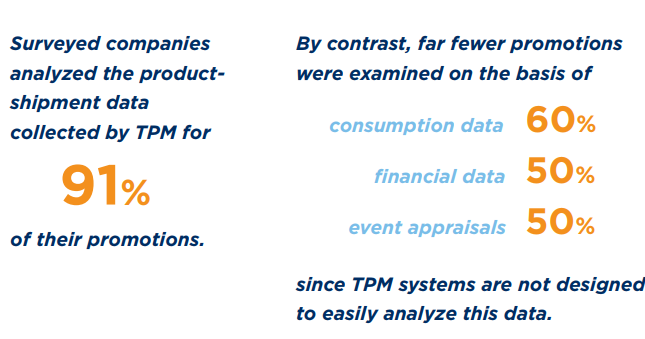

Of 24 CPG companies tested, all had some type of trade promotion management (TPM) System. Yet only one in three had a trade promotion optimization (TPO) system to help further analyze the results from the TPM system. This is problematic, considering 91 percent of TPM systems are measured based on product shipment data, and only 60 percent use consumption data. This information does not give accurate information about where or why trade promotions may be failing.

How to fix your plays:

Eddie Yoon, a director at the Cambridge Group and founder of Eddie Would Grow, argues two major points for trade promotion:

- Companies must use microscopes, not telescopes. He emphasizes that the data collected is often at too high a level, and the analysis must be much more detailed. Ideally, he states, data would be collected weekly, by store, and all the way down to the SKU level.

- Companies need need many data points rather than one broad piece of information. By having real-time, exact data points, the sales and marketing teams can address issues more effectively.

Write the new playbook:

Observa offers an easy solution for collecting this large quantity of necessary data. By using crowdsourced observers across the nation, Observa collects real-time individual retail execution data on command. We act as the retail microscope for brands and provide the necessary data to ensure the trade promotions provide a positive ROI.